As electric rates rise, gas-fired power emerges as both scapegoat and savior

WESTBROOK — In a building bigger than a football field, one of two 185-ton natural gas-fired turbines inside the Westbrook Energy Center is ramping up on a cloudy December afternoon.

A day earlier, the region’s electric grid operator in Massachusetts told the energy trading desk at Calpine Corp. in Houston to start the plant at 2 p.m. the following day and run until midnight.

Calpine is obligated every day to offer up to 550 megawatts of capacity from this plant to a wholesale energy bidding process run by regional grid operator ISO New England. That’s enough electricity to meet the needs of 550,000 homes.

These “day-ahead” bids are meant to assure that on each following day, the region will have enough generating capacity every second of every hour, regardless of weather or demand.

Westbrook doesn’t get selected every day. But when it does, it’s not hyperbole to say the plant is helping to keep the lights on in New England.

Despite its essential role, natural gas is under fire. In mid-November, the Maine Public Utilities Commission directly blamed high wholesale natural gas prices for the more than 80 percent jump in “standard offer” electric supply rates that most Central Maine Power and Versant Power home customers are starting to see in their bills this month.

Even more ominous, ISO New England warned in early December that limited gas pipeline capacity and liquified natural gas deliveries could put the region’s electricity supply in a “precarious position” if there’s an extended cold snap between now and spring.

So as winter deepens, natural gas is a study in contradictions. It seems to be simultaneously keeping the lights on, raising electric bills and contributing to the risk of rolling blackouts.

It’s a confusing set of circumstances for Mainers to pick apart.

Policymakers in Maine and the rest of New England are pushing an urgent transition to renewable energy to fight climate change, largely by encouraging solar and wind power. But despite the growth of renewables, natural gas plants such as the one in Westbrook will still make up half of the region’s generating capacity in 2022.

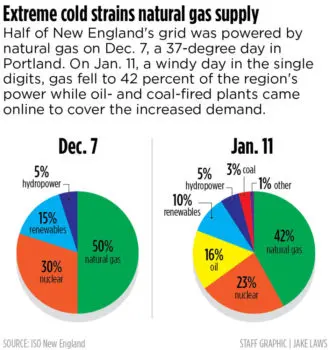

A look back at ISO New England data on that cloudy December day highlights the enduring role of natural gas. Fifty percent of the 20,913 megawatts of available capacity in the region was gas-fired. Thirty percent came from nuclear power and 6 percent from hydroelectric stations. Other renewables made up just 15 percent, mostly from wind farms.

Even in Maine, where the bulk of the state’s generating capacity is made up of hydro, wind and biomass, natural gas plays an outsize role. Gas plants generated 70 percent of the standard offer supply that the PUC approved for residential customers in CMP’s service area for a period in 2020 and 2021.

But last Tuesday, when morning temperatures in Maine plunged to zero or below, the limitations of gas were on full display.

But last Tuesday, when morning temperatures in Maine plunged to zero or below, the limitations of gas were on full display.

With gas in short supply or very expensive, oil became the “marginal fuel” on the grid, meaning it was being dispatched to generate the next megawatt of needed power. Gas generation dropped to 42 percent of the fuel mix while oil shot up 16 percent. On this cold day, it was oil that was keeping the lights on.

Maine’s largest power plant, 610-megawatt Wyman Station in Yarmouth, was pressed into service. Wyman rarely runs, but as dawn broke Tuesday, a plume of smoke rose from its 421-foot stack into the frigid air over Casco Bay.

On Saturday morning, another near-zero day with gusty winds, Wyman Station was running again. ISO-New England showed oil contributing 19 percent of generating capacity, with natural gas down to 32 percent.

And therein lies the paradoxical role of gas power and its impact on what Mainers will pay for electricity in the 2020s.

New England is racing to phase out fossil fuels – oil, coal and natural gas – and their climate-changing emissions. Experts call it decarbonization. But the energy sources that will replace them, largely solar and wind, can’t produce power 24/7.

So until economical, long-duration energy storage is developed and sited, existing gas-fired plants such as the Westbrook Energy Center will be needed to some degree.

Contributing to that need is the reality that always-on options such as Canadian hydro and nuclear power face opposition for a variety of reasons. Exhibit A is the proposed 1,200 megawatts of capacity from Quebec over the New England Clean Energy Connect transmission line.

Mainers voted to kill the project in November, in part because of allegations from critics that the line also could carry fossil fuel power. Construction has stopped, and the case is now before the Maine Supreme Judicial Court. Calpine, incidentally, helped fund the opposition campaign. It did so because NECEC’s power was expected to be less expensive than gas, which meant Westbrook would be dispatched less often by the grid operator.

FUTURE UNCERTAIN FOR GAS

How much gas plants will be needed, and for how long, is unclear and being hotly debated. Two studies done in 2020 show the difference of opinion.

A study commissioned by Calpine concluded that, while gas plants will run fewer hours in the future, they’ll still be essential players for decades. Their main role will be to provide reliability and firm capacity, the ability to start on demand and run as long as required.

Firm capacity will be even more crucial in the years ahead as the region moves to electrify its economy, using renewable energy to run cars and heat buildings. The trend is expected to shift periods of peak electric use from summer to winter, a season when heating demand is high and solar energy is at its low point.

“We think that through 2050, you’ll have to have gas in the resource mix,” said Seth Berend, vice president of power trading at Calpine.

But environmental activists say the imperative of slowing climate change means natural gas must be phased out much sooner.

A study by Acadia Center, a regional environmental group, suggests that gas generating capacity could be cut from nearly half to 10 percent by 2030. To get there, New England will need strategies that include greatly increasing the amount of clean energy generation and storage, as well as more so-called distributed energy resources such as small solar projects built close to where power is needed. The group also calls for halting any investment in new gas infrastructure.

“You can achieve the same goal at a lower cost and with lower impacts,” said Melissa Birchard, the group’s senior regulatory attorney.

One thing is beyond dispute: Natural gas is subject to wild price swings. When that happens, Maine electric rates will go along for the ride.

The past two years illustrate the point. In 2021, standard offer electric rates hit a very low 6.4 cents per kilowatt-hour. This year, they’re above 11 cents.

What happened? Experts blame an unusual confluence of global events last fall.

The pandemic and extreme weather disrupted fossil fuel production in the United States. European tensions with Russia limited gas imports, raising wholesale prices. High prices created incentives for record exports of liquified natural gas, fuel that could have been burned in the United States.

These and other disruptions were occurring just as the Maine PUC was requesting bids for standard offer electricity supply for 2022, in a region with a pipeline system that struggles to keep up with demand during the coldest days. On those days, wholesale gas prices can skyrocket.

“This is why the standard offer rate went up,” said Drew Landry, Maine’s deputy public advocate. “The standard offer suppliers had to build into their calculations the risk that, sometime in January or February, they may have to pay an extreme price. The alternative to paying that price is the lights going out.”

There’s an adage in the utility industry: Most people only think about electricity when they get their monthly bill or if they flip the light switch and nothing happens. For 2022, at least, higher monthly bills will be the price Mainers pay to avoid the second consequence.

In two short decades, natural gas has gone from savior to scapegoat in New England. Its promise as a cleaner-burning fuel has been eclipsed by alarm over the climate-changing contribution of methane, the largest component in natural gas.

In 2000, the region’s generation mix was dominated by nuclear power, oil and coal. Natural gas contributed 15 percent. The nation’s gas pipeline system actually ended in Lewiston.

But public opposition to nuclear power solidified after the Three Mile Island nuclear plant accident in 1979. A failed effort to build a second reactor at Seabrook, New Hampshire, led its owner to declare bankruptcy in 1988. In 1997, Maine Yankee in Wiscasset shut down, too expensive to repair and maintain. At the same time, pressure was mounting to close highly polluting oil and coal plants.

Where would New England’s electricity come from in the 21st century?

By chance, new gas deposits were discovered in western Canada, off Nova Scotia and in Pennsylvania and New York. Natural gas was hailed as a “bridge” fuel, a source to move America past dirty coal and oil on the way to a renewable-energy future.

Soon, new high-pressure pipelines were being developed – two of them that bisect Maine and went into service in 1999: Portland Natural Gas Transmission System and Maritimes & Northeast Pipeline. Complementing the supply was a new liquified natural gas import terminal in Saint John, New Brunswick, completed in 2009.

Developers began building power plants near these lines to take advantage of the new supply and the region’s newly deregulated wholesale electricity market. Among the first was the Calpine plant in Westbrook, completed in 2001.

The Westbrook plant was part of a new generation using combined-cycle technology, in which waste heat in the gas turbine exhaust is recovered and sent to the steam turbine, greatly increasing efficiency and reducing airborne emissions.

RELIABLE POWER AT A PRICE

On that cloudy December afternoon, two operators were sitting in the plant’s control room. Monitoring 19 computer screens, the men were confirming that pumps, feed water and other systems were engaged as they prepared to put half the plant’s output on line.

“We never know what we’re going to run tomorrow until we get our day-ahead awards,” said Holly Bragdon, the plant’s manager.

Water must be heated to 2,000 degrees to start the steam turbine, Bragdon explained. Because the plant ran the day before, the system was still hot enough for power to ramp up in one hour. A cold start could take four hours. But newer plants can respond even quicker, illustrating the as-needed, balancing act for gas in a growing mix of intermittent renewable generators.

As the plant came to life, Bragdon received an email from Berend’s team at Calpine’s power trading desk in Houston. It said ISO New England wanted the plant to shut down that night but start both turbines the next day, two hours apart.

Calpine is paid – through ratepayer charges – to offer the plant’s full output every day or face financial penalties. This is how the lights stay on in New England.

But even without Canadian hydro, the plant isn’t needed as much as it used to be.

Federal energy data show that Westbrook ran at 79 percent capacity in 2002. Today, it’s closer to 20 percent. One reason is the once-cheap offshore gas from Nova Scotia has petered out over 20 years. Another is that wind and solar are filling in more hours as their capacities increase.

But solar panels don’t work in the evening or at night. Land-based wind turbines are sluggish on most summer days. Massive offshore wind farms and long-duration storage could change things, but not right away. For instance, the region’s largest battery storage project is scheduled to come on line in Gorham in 2024, rated at 175 megawatts of capacity for two hours.

“There’s still a big need for gas at certain hours,” Berend said.

The problem is, gas in New England is more costly than in other parts of the country. At certain hours of peak winter demand, prices can spike. That’s because the system that brings gas into the region from the south is barely big enough to handle demand from both power plants and the thousands of homes and businesses that have converted from oil to gas since 2000. For perspective, the Sappi paper mill in Skowhegan, which made the switch in 2014, uses enough gas each year to offset up to 4.2 million gallons of industrial-grade oil.

Seeking to lower wholesale prices in New England, industry groups tried for years to expand the gas supply network. Many Maine political leaders were on board with that goal in 2012, when former Gov. Paul LePage and Republicans controlled state government. They wanted Maine electric customers to help subsidize new gas lines in New England, arguing that the cost reduction in power would be worth it. That plan failed to advance, in part because residents and politicians in Massachusetts opposed a major new pipeline, Kinder-Morgan’s Northeast Energy Direct.

Opposition has only hardened since then. Critics have even renamed the fuel, calling it “fossil gas” or “fracked gas,” slang name for the hydrofracturing technology used to extract gas from bedrock formations. Even the idea of extending distribution lines can be met with community resistance, as Summit Natural Gas discovered last year after announcing plans to expand in the midcoast. In March, the company withdrew efforts to build a $90 million pipeline to Rockland.

Based on the deepening opposition, it’s widely assumed that no new gas pipeline infrastructure will be built in the region, according to Matt Kakley, a spokesman for ISO New England. That could make plants such as Westbrook even more valuable to ensure grid reliability during the region’s transition to renewables.

“We see them as important in the short term or even the medium term,” Kakley said. “Down the road it might be storage, but right now, natural gas is playing that role.”

Read the full article at the Portland Press Herald here.

Follow us