How Trump’s big law impacts Massachusetts

The massive tax and domestic policy bill passed by Congressional Republicans and signed by President Trump this month expands tax cuts, limits Medicaid and food assistance programs, balloons immigration enforcement spending, and adds trillions to the national debt.

The WBUR newsroom took a look at how some key provisions may affect residents and programs in Massachusetts.

“The [Big Beautiful Bill] is bad, bad, bad for Massachusetts. Bad for ratepayers’ wallets, bad for grid reliability, bad for energy independence,” wrote Kyle Murray, Massachusetts program director at the Acadia Center, a climate advocacy and research group, in an email. “It will be a setback for the clean energy industry and will force Massachusetts to adopt new creative strategies to keep vital public policy goals on track.”

To read the full article from wbur, click here.

Batteries are playing a bigger role in keeping the lights on during New England heat waves

Battery storage and small-scale solar played a critical role in keeping New England’s electric grid reliable and may have saved customers tens of millions of dollars during late June’s major heat wave, according to a new analysis.

As temperatures soared above 100 degrees Fahrenheit and the region saw thick humidity, people cranked their air conditioners, drawing more power from the grid.

That shift could have saved consumers more than $19 million, according to an analysis by the Acadia Center, a regional environmental nonprofit and thinktank.

Absent all that rooftop solar, Acadia Center estimates New England would have broken its 19-year record for peak demand.

Power banking

The Acadia Center and ISO New England say power storage also played a critical role in keeping the lights on during this heat wave.

“I think people are really starting to understand that the value of renewables increases substantially when you pair them with batteries,” said Noah Berman, with the Acadia Group.

Batteries — whether smaller ones in people’s homes, or bigger “utility scale” ones plugged into the regional transmission grid — store power when it’s cheap and plentiful, like solar energy in the middle of the day.

Analysts with the Acadia Center hope batteries and a little extra coordination on the part of grid operators and utilities could help make that future winter peak lower, saving money and carbon emissions.

To read the full article from Vermont Public, click here.

Behind-the-meter Solar Shines in ISO-NE Capacity Deficiency Event

ISO-NE’s capacity deficiency event demonstrated the significant benefits of solar resources, along with their limits in displacing fossil resources during peak load periods.

Amid the rapid growth of behind-the-meter (BTM) solar in New England, a capacity deficiency event demonstrated the significant benefits of solar resources, along with their limits in displacing fossil resources during peak load periods.

Without the contributions of BTM solar, ISO-NE estimates the peak would have reached over 28,400 MW at about 3:40 p.m. The 2,400-MW reduction in the region’s peak provided significant cost and reliability benefits to the grid. According to an analysis by the Acadia Center, “BTM solar avoided as much as roughly $19.4 million in costs on this single day by suppressing the overall price of wholesale electricity.

In the wake of the capacity deficiency event, clean energy advocates made the case that increased energy storage capacity would have provided significant benefits during the peak.

“Had we had even more behind-the-meter solar paired with storage online, we could have potentially completely avoided that absurd price spike later in the evening,” said Kyle Murray of the Acadia Center at the June 25 hearing.

The Acadia Center wrote in its analysis of the event that there is “clear evidence that additional BTM battery energy storage would have been able to further reduce the overall cost to consumers by increasing flexibility and shifting the solar production later in the day, dampening the early evening peak prices.”

To read the full article from RTO Insider, click here.

A heat wave hit New England’s grid. Clean energy saved the day.

As temperatures across New England soared above 100 degrees Fahrenheit in recent weeks, solar panels and batteries helped keep air conditioners running while reducing fossil-fuel generation and likely saving consumers more than $20 million.

“Local solar, energy efficiency, and other clean energy resources helped make the power grid more reliable and more affordable for consumers,” said Jamie Dickerson, senior director of clean energy and climate programs at the Acadia Center, a regional nonprofit that analyzed clean energy’s financial benefits during the recent heat wave.

At the same time, rooftop and other “behind-the-meter” solar panels throughout the region, plus Vermont’s network of thousands of batteries, supplied several gigawatts of needed power, reducing demand on an already-strained system and saving customers millions of dollars. It was a demonstration, supporters say, of the way clean energy and battery storage can make the grid less carbon-intensive and more resilient, adaptable, and affordable as climate change drives increased extreme weather events.

“As we see more extremes, the region still will need to pursue an even more robust and diverse fleet of clean energy resources,” Dickerson said. “The power grid was not built for climate change.”

On June 24, behind-the-meter solar made up as much as 22% of the power being used in New England at any given time, according to the Acadia Center. At 3:40 p.m., total demand peaked at 28.5 GW, of which 4.4 GW was met by solar installed by homeowners, businesses, and other institutions.

As wholesale power prices surpassed $1,000 per megawatt-hour, this avoided consumption from the grid saved consumers at least $8.2 million, according to the Acadia Center.

This estimate, however, is conservative, Dickerson said. He and his colleagues also did a more rigorous analysis accounting for the fact that solar suppresses wholesale energy prices by reducing overall demand on the system. By these calculations, the true savings for consumers actually topped $19 million, and even that seems low, Dickerson said.

To read the full article from Canary Media, click here.

FOR RELEASE: RGGI States Finalize Program Updates to Support Clean Air and Affordable Energy through 2037

MEDIA CONTACTS

Paola Moncada Tamayo

Senior Policy and Data Analyst

ptamayo@acadiacenter.org; 860-246-7121 x204

Jamie Dickerson

Senior Director, Climate and Clean Energy Programs

jdickerson@acadiacenter.org; 401-276-0600 x102

ROCKPORT, ME – On Thursday, July 3, 2025, the ten states participating in the Regional Greenhouse Gas Initiative (RGGI) announced the conclusion of the program’s Third Program Review, finalizing a long process for updates aimed at reinforcing the region’s power sector transition and related climate and energy affordability goals. The agreement by the states will allow for the program’s benefits to continue through 2037, which to-date have brought $20 billion in energy bill savings through the investment of proceeds. RGGI has proven the power of multi-state collaboration, and the continuation of the program will ensure steady investments to benefit consumers, address energy affordability, support communities, and increase economic output. The agreement includes several important changes to strengthen and future-proof the program for consumer and community benefits, including: a strengthened emissions cap through 2037, new market mechanisms, the removal of offsets for program compliance, and a commitment to continued progress. Acadia Center applauds the RGGI states and RGGI, Inc., for bringing this updated model rule to fruition during a period of unprecedented uncertainty.

“RGGI has long demonstrated its effectiveness in providing consumers with large benefits in energy savings and investments in a cleaner future” said Daniel Sosland, president of Acadia Center. “RGGI program improvements reflect the power of bipartisan states’ cooperation to work together toward a cleaner energy future. We look forward to supporting their efforts as they move into the implementation phase and ensuring that the benefits of this program reach households and communities across the region.”

The conclusion of the program review and associated updated model rule bring clarity to several important program and market mechanisms that affect the program’s operation and its resulting impacts to power plants, communities, consumers, and other stakeholders. The program mechanisms described below will work together not only to reduce detrimental pollution that harms public health, but also to enhance the program’s ability to keep delivering tangible financial and energy benefits to consumers and the public.

Key Program Updates:

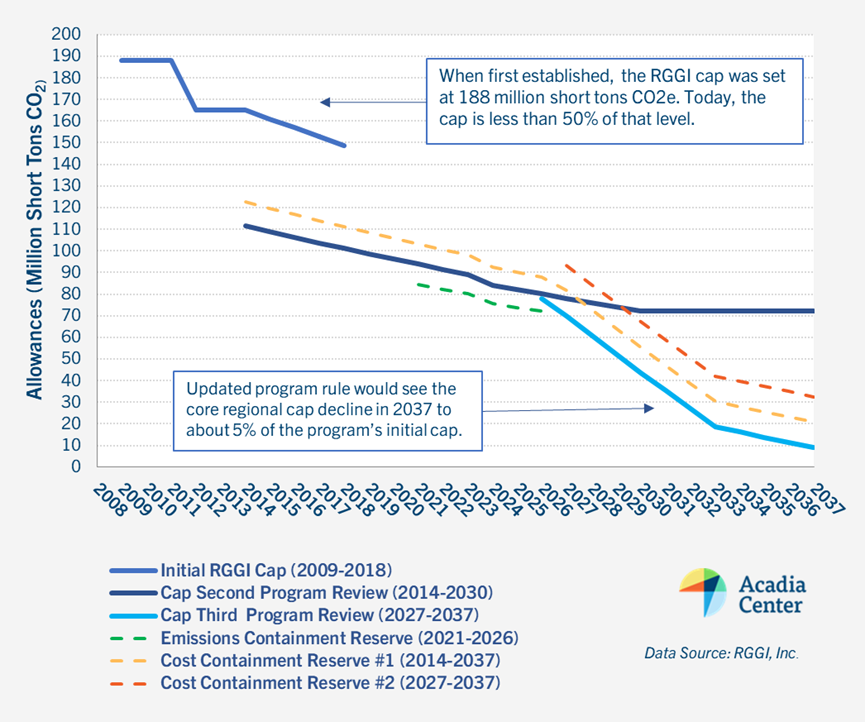

- Stronger Emissions Cap: Beginning in 2027, the new regional cap puts the ten states on a declining trajectory to reach just under 10 million tons of carbon dioxide equivalent (CO2e) emissions from the power sector by 2037, down from a cap of 82 million tons of CO2e emissions today and a cap of 188 million tons CO2e when the program first held auctions in 2008. Backed by state policy and consistent market direction, it is a positive step forward that demonstrates a strong, multi-state commitment to grid decarbonization.

- Removal of Offsets: Historically, the RGGI program has allowed power generators to use offset allowances representing GHG reductions achieved outside the power sector (e.g., avoided agricultural methane) to meet their emission reduction requirements. RGGI will no longer issue offset allowances beginning in 2027, simplifying program design and reinforcing the focus on direct emissions reductions in the power sector.

- A New Cost Containment Reserve Market Mechanism: A two-tier Cost Containment Reserve (CCR) will be instituted with the objective of helping manage cost volatility while maintaining cap integrity across the ten-state region.

- Minimum Price Floor: The existing Emissions Containment Reserve (ECR) will be replaced by a higher minimum price floor, set at $9 in 2027 and increasing by 7% annually, ensuring RGGI sends a stronger lower bound price signal to power generators.

The updated Model Rule provides the framework for each participating state to revise its own rules through legislative or regulatory processes, with the goal of implementing these changes by January 1, 2027.

Since the first auction in 2008, RGGI has steadily evolved through three program reviews to become an effective policy tool for emission reductions and regional collaboration. The chart above illustrates how the emissions cap has tightened significantly over time, from an initial 188 million tons to a projected 10 million tons in 2037. The new cap trajectory from the Third Program Review sends a strong signal to markets and power providers that the decarbonization of the power sector is not only possible but already underway across the region and expected to continue, irrespective of countervailing changes at the federal level.

Acadia Center’s full set of Findings and Recommendations for the Third Program Review Report helped shape the discussion by offering proposals to strengthen program impact, enhance equity in proceeds spending, and address other longer-term elements of the program’s evolution.

A Proven Track-Record of Success

RGGI is the United States’ first multi-state program designed to reduce pollution from power plants, providing significant benefits for the participating states and their consumers and communities. Since its inception, RGGI has contributed to nearly 50% reduction in CO₂ emissions from covered power plants. The program has generated over $9 billion in proceeds, which states have invested in clean energy, energy efficiency, and bill assistance programs that benefit local communities and consumers.

RGGI announced that program investments have directly benefited more than 8 million households and 400,000 businesses and are expected to save ratepayers over $20 billion on energy bills. A recent analysis by Acadia Center, RGGI Proceeds in Action, highlights in further detail how states have used these investments to deliver benefits to communities and consumers, along with recommendations for improved reporting and proceed investments.

Looking Ahead

As part of this announcement, the RGGI states have committed to launching a Fourth Program Review no later than 2028. This future review will assess the performance of the newly adopted changes, consider additional adjustments as needed, and further explore opportunities to ensure a reliable, equitable, and clean electricity system across the region.

The updated framework also leaves the door open for future participation by additional states, which would bring greater economic efficiency and climate benefit to the region as a whole.

The graph above focuses on the cumulative RGGI cap over the 200-2037 time period for the ten states that currently participate in RGGI and assumes New Jersey did not exit the program from 2012-2019 for the sake of visual clarity.

Report: Clean energy kept lights on during New England heat wave

A new report revealed how local, “behind-the-meter” solar installations came to the rescue during New England’s recent historic heat wave.

On June 24, ISO New England issued a “power caution” and multiple energy alerts as record temperatures triggered a decade-high electricity demand.

Jamie Dickerson, senior director of clean energy and climate programs at the nonprofit Acadia Center, said solar panels helped ensure people had power throughout the day.

“Solar was helping not just deliver megawatt-hours but also suppressing demand for the entire region,” Dickerson pointed out. “Basically helping ensure that the grid could keep the lights on, could keep the air conditioning running.”

He added it helped save ISO customers more than $8 million on one of the most expensive power days of the year.

Renewable energy backers warn the loss of federal tax credits for solar panels and other green technologies will only slow future development and limit the region’s response to the next peak power event.

Landmark investments in clean energy made possible by the Inflation Reduction Act were largely eliminated by the federal budget bill signed into law by President Donald Trump last week. Massachusetts taxpayers alone benefited from more than $200 million in tax credits for home energy efficiency updates.

Dickerson noted the improvements ease the burden on the power grid in a warming climate.

“Those resources are susceptible to equipment failure and to outages, and there is correlated outage risk across the very large fleet of natural gas generation in the region,” Dickerson explained. “All the more reason why we need to diversify the region’s portfolio.”

He emphasized the removal of federal tax credits will not entirely handicap states’ ability to increase solar development. Massachusetts recently revised its solar program to encourage development in low-income communities as well as rooftop solar installations.

To read the full article from Public News Service, click here.

Rooftop solar strengthens electric grid during recent heat wave

Experts say that roof mounted solar panels moderated electric demand and prices on the New England electric grid during the recent heat wave.

Jamie Dickerson with Acadia Center, an energy nonprofit, said so-called ‘behind the meter’ solar sent to homes and businesses reduces the overall need for electricity at peak periods.

During intense heat on June 24, generation from homes and businesses helped keep the grid running even as operator ISO New England was forced to fire up reserve energy resources after it fell short of requirements.

“Clean energy in fact saved consumers millions of dollars in wholesale electricity market costs and played a vital role in keeping the light on and the air conditioning running,” Dickerson said.

To read the full article from Maine Public, click here.

A Heat Pump Might Be Right for Your Home. Here’s Everything to Know.

They’re the most energy-efficient way to handle both heating and cooling in your home; they also tend to be the most affordable choice in the long term, once you factor in tax credits and incentives as well as decreased utility bills. And they’re usually better for the environment and generally considered to be one of the best ways for homeowners to reduce their carbon footprint without sacrificing comfort. In other words, they’re a win-win.

“A heat pump is probably the biggest thing that consumers can do to help fight the climate crisis,” said Amy Boyd, director of policy for the Acadia Center, a regional research and advocacy organization focusing on clean-energy policy in the Northeast.

Heat pumps also happen to rank among the quietest and most comfortable options available for home heating and cooling.

To read the full article from New York Times’ Wirecutter, click here.

A Message from Acadia Center President, Daniel Sosland on the Passage of the “Big Beautiful Bill”

The so-called ‘Big Beautiful Bill’ is a direct attack on our clean energy future, public health, and the citizen input that is essential to a functioning democracy. By slashing clean energy investments and tax credits, it will raise consumer costs—hiking energy bills by $110 next year and $400 annually within five years—while killing jobs in renewable energy and forcing reliance on expensive, volatile fossil fuels. The bill will severely increase risks to the reliability of our power grid by kneecapping the very clean energy resources that are quickest to deploy, most cost effective, and just recently came to the rescue during a historic summer heat wave event. At the same time, it weakens air pollution controls, increasing asthma, heart disease, and premature deaths, all while cutting Medicaid funding, disproportionately harming low-wealth and communities of color. What’s more, it silences the public and limits scrutiny, allowing developers to short-cut environmental reviews and bypass community input while handing millions of acres of public lands to oil and gas companies. This bill isn’t just bad policy—it’s a giveaway to the most powerful at the expense of working families, public health, and the climate. It is a sad day in America when laws are enacted – by a single vote – to override the right to clean air, affordable energy, and a say in our future. Acadia Center is determined to make the case for a clean energy future, support state and community action, rebut false claims and document the damage done to clean air and energy affordability by this regressive legislation.

How rooftop solar is helping New England stay cool during the heat wave

As New England bakes during the first heat wave of the summer, electricity use is surging. The power grid has so far been able to meet the demand, thanks in part to an assist from the sun.

Around the region, thousands of solar panels on rooftops, over parking lots and along the sides of roads are converting sunlight into electricity and helping relieve stress on the grid.

“Behind-the-meter solar is already benefiting New Englanders by shaving summertime peaks” in energy demand, said Joe LaRusso, manager of the Clean Grid Program at the Acadia Center, a nonprofit focused on clean energy research and advocacy.

Most of New England’s electricity comes from burning natural gas and nuclear power. But when energy use spikes, the grid operator turns to “peaker plants” to help meet the demand. These tend to be older, more polluting facilities that are expensive to operate; in New England, many of them burn oil or coal.

“Without behind-the-meter solar, New England would have needed to burn that much more coal and oil to balance the supply of electricity with customer demand.” LaRusso said. “It reduces the cost of meeting the peak, and reduces system-wide emissions that contain not only carbon, but other pollutants including airborne particles that can cause respiratory illnesses.”

As evening fell on Monday, solar production dropped off, and oil production increased. By 7 p.m., oil and coal accounted for about 1,900 megawatts of power on the grid. In the future, LaRusso said, as more behind-the-meter solar is installed, and batteries to store excess power become more common, he hopes the region can rely even less on peaker plants to get through heat waves.

To read the full article from wbur, click here.

Follow us