An EnergyVision for Puerto Rico

When Hurricane Maria hit Puerto Rico on September 20, it plunged the island into a devastating power outage. This NOAA satellite photo shows visible lights in Puerto Rico and the U.S. Virgin Islands before the storm (July 24) and after (October 13). It took two months to restore more than half of normal peak load electricity, as of early-December, almost a third of households are still in the dark.

In May, Acadia Center released EnergyVision 2030: Transitioning to a Low-Emissions Energy System, a comprehensive analysis that demonstrates how seven Northeast states can spur use of market-ready technologies that empower consumers, control energy costs, and advance economic growth while lowering carbon pollution. EnergyVision 2030 presents a practical path to a clean energy future where electricity produced by solar, wind, and other renewable technologies powers our cars and provides efficient heating; where residents and businesses anchor an integrated grid, with power flowing between consumers and among smart appliances and batteries, within energy efficient buildings; and where community energy provides equitable access to renters, low-income ratepayers, and those who cannot site clean energy at their own homes. EnergyVision 2030 is ambitious, optimistic, and achievable.

In September, Hurricanes Irma and Maria devastated Puerto Rico, leaving 3.4 million people without power, clean water, food, or cell phone service. Almost three months later, a third of the island is still in the dark. While officials warn that it will take many more months and many billions of dollars to repair the island’s electricity transmission and distribution system and restore some sort of normalcy, creative thinkers are asking what might be possible if—instead of fast-tracking huge investments in rebuilding Puerto Rico’s troubled, traditional grid— Puerto Rico builds an affordable clean energy system of the future.

This clean energy future would be a significant departure from Puerto Rico’s pre-hurricane energy system, which depended heavily on fossil fuels and resulted in the highest retail electricity prices for American citizens outside of Hawaii. Despite including both the Caribbean’s largest solar farm and its largest wind farm, renewable energy supplied only 2.4% of Puerto Rico’s electricity in 2016. That’s far short of the 2010 Renewable Portfolio Standard (“RPS”) requiring the Puerto Rico Electric Power Authority (“PREPA”) to get 12% of its electricity from renewable sources starting in 2015, scaling up to 15% by 2020 and 20% by 2035. Missing the RPS target is not PREPA’s only problem. The agency’s debt tops $9 billion, its infrastructure is old and failing, and service is often unreliable. The bottom line is that Puerto Rico was ripe for grid modernization even before Hurricane Maria wiped out the grid.

Weaving strategic grid modernization into emergency response will require sensitivity, and Acadia Center’s EnergyVision lays the foundation for ambitious, achievable reforms anchored by clean energy technologies in four core areas:

Grid Modernization: Advocates on Puerto Rico and the mainland are abuzz with the potential of a modern system of microgrids. These localized grids incorporate renewable generation and battery storage to avoid the need for expensive long-distance transmission and distribution lines, and are more resilient than traditional, centralized grids. The impact of Hurricane Maria bears this out: though the storm took out 80% of transmission lines, it damaged only 10-15% of solar panels. Functioning panels weren’t able to deliver power to the now-destroyed grid, but interconnecting those panels through local microgrids would be particularly useful, especially given Puerto Rico’s terrain of forests and mountains through which it is difficult to maintain power lines. Renewable energy companies have stepped up since the hurricanes: German energy storage manufacturer Sonnen already has six microgrids up and running, with nine more installations planned in coming weeks; Tesla deployed solar and storage to restore power at San Juan’s Children’s Hospital and has announced six new battery projects on two Puerto Rican islands. Taxpayer-funded disaster relief should encourage innovations like these to lend immediate support to traumatized Puerto Ricans and to demonstrate the potential of a smart, clean, modern grid.

Electric Generation: Puerto Rico has ample renewable resources, yet last year, petroleum supplied nearly half of the island’s electricity, and natural gas supplied nearly one-third. Solar power is the fastest source of clean, renewable generation. As of June 2017, Puerto Rico had five utility-scale solar farms with 127 megawatts of capacity, and more than 8,500 customers with nearly 88 megawatts of distributed capacity connected with net metering. Expanding grid-scale and distributed renewable generation to achieve and surpass RPS targets will mitigate high fuel costs, advance energy independence, reduce emissions, and support a more resilient energy system.

Buildings: Energy efficiency and clean building-cooling and water-heating technologies have already provided cost savings and emissions reductions in Puerto Rico. The island utilized funds from the American Recovery and Reinvestment Act to weatherize more than 15,000 homes, cutting electricity use by an average of 15%, and to install more than 11,000 solar hot water heaters. As it rebuilds, Puerto Rico should maintain its requirement that all new single-family homes have solar hot water heaters, and also require minimum efficiency standards for homes, municipal, and commercial buildings.

Transportation: Hurricane Maria severely damaged Puerto Rico’s critical transportation infrastructure, including highways, bridges, traffic signals, and fuel stations. Immediate recovery efforts focused on clearing and repairing roads and reopening gas stations to facilitate relief efforts and restore local and regional bus service. Longer term efforts should recognize the potential of electric vehicles and innovations in mobility options to improve transportation efficiency and resiliency, and strive to build a robust network of electric vehicle charging stations.

EnergyVision 2030 calls for a resilient, low-emissions energy system that benefits communities every day, and especially in the face of extreme weather events and volatile global fuel markets. Acadia Center advocates in the Northeast for a consumer-friendly grid, clean distributed generation, and efficient buildings and transportation, but this can and should be pursued everywhere. Puerto Rico needs this critical help now.

Action Guide Identifies Barriers to Community Energy—Resilient Microgrids Could Have Helped Maine Bounce Back from Storm Damage

Of the many economic, energy, and environmental benefits of a clean, modernized community energy system, one might stand out for electric customers across the Northeast right now: resiliency.

More than 1.5 million homes lost power when hurricane-force winds and torrential rain battered New England in late October. In Maine, toppled trees blocked roads, damaged homes and cars, and pulled down power lines, contributing to outages that left nearly two-thirds of the state without power. The emergency response was hardly a picture of resilience: despite the efforts of more than 3,000 state agency and utility workers from 14 states and three Canadian provinces, it took more than a week to restore service statewide.

Neighbors rallied to keep each other warm and fed, but updating the way we plan, manage, and invest in our electric grid would give communities the freedom to do even more. Acadia Center’s Community|EnergyVision Action Guide highlights how communities can create more resilient energy systems by leveraging available technologies to generate, distribute, and use power in a cleaner, more consumer-friendly way. The Action Guide also reveals where current state rules limit—and even prohibit—community action.

New England’s recent and historic wind storm is a stark reminder that obstacles to community energy leave residents vulnerable. Power outages are inconvenient, dangerous, and expensive—and so are the workarounds many municipalities, businesses, and residents turn to during lingering blackouts.

- Sales of portable fossil-fueled generators spike, boosting profits for manufacturers and retailers, but creating safety risks for homeowners and line workers, worsening local air quality, and creating a maddening din as whole neighborhoods run noisy generators.

- Even at critical facilities like hospitals, water and sewage treatment plants, and emergency shelters, back-up generators may not be effective for extended periods. During the October storm, eight million gallons of untreated sewage flowed into the Merrimack River when back-up generators failed at a Massachusetts treatment plant.

- CMP has 30 days to provide an estimate for storm recovery costs, but in New Hampshire, where fewer than half as many customers lost power, damage is expected to top $35 million. Whatever the final tally, ratepayers will pick up most of the tab.

Communities need better, more resilient energy systems, and they deserve the freedom to access and control clean, affordable, local energy. Microgrids are a key component of this clean energy future. These self-contained power systems can combine distributed renewable generation resources with demand optimization and energy storage to serve their immediate geographical area. Microgrids can operate as part of the main electrical grid or go into “island” mode to operate separately from the grid during power outages.

Microgrids improve resiliency because they provide electrical service to a concentrated area and their generation and storage sources can be distributed across that area—with multiple rooftop solar installations, for example. This compact, yet decentralized, approach makes microgrids more rugged overall, reducing their vulnerability to the service disruptions that go along with long-distance transmission and distribution lines.

Microgrids became a focus of many state resiliency plans after Hurricane Sandy in 2012, and those on-line in Texas helped keep stores and hospitals open during Hurricane Harvey. Even in good weather, microgrids add value to a community. Vermont’s Stafford Hill solar and storage microgrid not only powers Rutland’s emergency shelter, it yields $380,000-$700,000 annually in energy storage benefits and land-lease fees.

Maine communities are ripe for microgrids, yet there is no clear authority for municipalities to act. Acadia Center’s Community|EnergyVision Action Guide notes that communities would have a clearer path if policymakers established specific rules enabling developers and stakeholders to collaborate on microgrids that enable local clean energy generation, use distributed energy storage, and improve control over energy consumption; add resilient capacity and stability to the larger grid; and operate independently at critical times.

When legislators return to Augusta in January, they will consider An Act to Enable Municipalities Working with Utilities to Establish Microgrids (LD 257). There was an informational meeting on the bill last month—just days before the majority of Mainers lost power—and there will be public hearings and work sessions in early 2018. Please join Acadia Center in sharing the impact of an outdated, inflexible power grid and demanding expanded community energy options to enhance resiliency.

Acadia Center Strengthens New York Office and Hires New York State Director

It is an exciting time for clean energy issues in New York. New York’s ongoing Reforming the Energy Vision (REV) proceeding, its goal of 50% renewable energy by 2030, and its continued participation in the Regional Greenhouse Gas Initiative provide key elements for the future of the state’s energy system. Acadia Center’s recently completed report, EnergyVision 2030, shows that New York can reduce emissions 45% and be on a path to a clean energy system by the year 2030 if the state acts now to further strengthen its commitment to clean energy technologies. To facilitate the action necessary to achieve this vision for all New Yorkers, Acadia Center has taken the next step, strengthening its staffing capacity in New York and hiring a full-time staff director of its New York program.

Acadia Center has been active on selected issues in the state for several years, participating with colleague organizations in the Regional Greenhouse Gas Initiative and other energy and climate issues. New York’s REV process—one of the most comprehensive reassessments of energy policy occurring in the country—has offered opportunities for Acadia Center’s experience in energy policy, energy efficiency and climate mitigation to be applied in New York forums. Fully active in the many REV proceedings, Acadia Center has focused on energy efficiency, power grid modernization, and climate policy. In 2015, by invitation of the Rockefeller Brothers Fund, Acadia Center hosted a multiday meeting at the Pocantico Conference Center focusing on utility reform and grid modernization issues. Beginning in 2015, the organization helped to protect the integrity of New York’s new Clean Energy Standard by successfully arguing against counting large hydropower as a renewable resource eligible for ratepayer support. In addition, it participated in the settlement phases of Con Edison’s most recent rate case and successfully advocated for the utility to increase its investments in energy efficiency.

This past July, this work ramped up when Acadia Center hired me as Senior Attorney as its inaugural New York Director, joining Acadia Center’s New York project team of lawyers and energy policy experts. I’ve joined the team at an exciting moment for the organization and the state. I came to Acadia Center from the New York City Council, where I had been a legislative counsel and was responsible for drafting and negotiating a wide variety of legislation focused on energy efficiency, clean energy, and sustainability. Before that I was an environmental law specialist at Arnold & Porter Kaye Scholer’s New York City office, where I focused on federal and state environmental issues involving climate change, energy efficiency, and green buildings. My work at Acadia Center largely focuses on policies that I’ve been working on throughout my career—policies that move us toward a future fueled by clean energy and energy efficiency.

One of my first tasks has been representing Acadia Center in a rate case brought by National Grid. The utility is seeking to increase customer rates by $331 million beginning next year. Acadia Center has focused on National Grid’s high fixed customer charges, which are charges all customers pay regardless of the amount of electricity they use. In most states, fixed charges range between $5 and $10 a month for residential customers, but in some states, including New York, these charges are much higher.

Since I started in the role of director, Acadia Center has released a paper explaining the problems with high utility fixed charges, which detrimentally impact consumer incentives to invest in energy efficiency and solar power, and the organization has filed testimony in the rate case stating that a reasonable range for customer charges would be between $5.57 and $8.30. We have also focused outreach efforts on educating consumers about the issue of high fixed charges and about opportunities to make their voices heard. This work will continue as Acadia Center expands its reach in New York, advocating for sustainable solutions across the energy system.

No. 1 on Our List of Back to School Supplies: Electric School Buses

The beginning of September signifies the beginning of the school year for many students. Across the country, 26 million, or over half of school-aged children are transported by 480,000 school buses.1 In an average school year, each bus travels about 12,000 miles, using 1,714 gallons of diesel fuel2 and producing about 17 MMT of CO2 emissions,3 as well as other harmful emissions such as nitrogen oxides and particulate matter. Electric school buses offer a viable alternative to diesel buses, and offer a solution to the health and environmental impacts of burning diesel fuel.

A relatively new option, electric school buses are being tested in early-stage pilot programs in both California and Massachusetts. The growing interest in electric school bus deployment is evident in the increase of funding opportunities for ZEV school buses: Blue Bird, a major school bus manufacturer, is the recipient of a grant to manufacture new electric bus models;4 three school districts in Sacramento, California, received a grant for an electric school bus pilot with funds from their cap-and-trade program;5 and the Massachusetts Department of Energy Resources awarded grants to four districts participating in an electric school bus Vehicle-to-Grid (V2G) pilot program.6

The Massachusetts pilot is of particular interest, as it seeks to demonstrate the feasibility of incorporating V2G technology, through which the electric school buses connect to the grid while not in use, allowing for two-way charging and battery storage. Because most school buses are in use for about 5 hours each weekday on predictable schedules, they are good candidates for V2G for battery storage and improved management of grid-level supply and demand.7

Current acquisition costs for electric school buses are between $250,000 to $300,000—roughly $100,000 to$120,000 more than a diesel school bus. However, the use of electricity to power the buses would displace significant fuel costs over the vehicle’s lifetime. For example, an electric school bus pilot in California is expected to save the host school district $10,000 annually in fuel and maintenance costs.8 There are also a number of potential funding sources to assist with the upfront purchase cost, including funding from the Diesel Emissions Reduction Act, Volkswagen Settlement Funds, and state programs such as California’s vouchers through the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Program. Prices for batteries are expected to decline significantly in the future, too, especially as demand increases. A study through the California Air Resources Board (CARB) indicated a possible 41% reduction in battery price based on an increase from 300 to 10,000 battery systems produced per year.9

Electric school buses are an interesting alternative to diesel and are on a path to become an increasingly beneficial clean energy technology. As the electric school bus market develops, the financial feasibility of electric buses will continue to grow, and more information about the successes and limitations of electric school buses will become available as pilot programs mature.

1 http://www.americanschoolbuscouncil.org/issues/environmental-benefits

2 http://www.americanschoolbuscouncil.org/issues/environmental-benefits

3 https://nnsa.energy.gov/sites/default/files/nnsa/08-14-multiplefiles/DOE%202012.pdf

4 https://www.blue-bird.com/blue-bird/Press-Releases/Blue-Bird-Awarded-44-Million-to-Develop-Electric-S-95.aspx

5 http://stnonline.com/news/latest-news/item/8613-largest-us-electric-school-bus-pilot-comes-to-california

6 http://www.mass.gov/eea/pr-2016/electric-school-bus-grants-to-four-schools.html

7 http://www.schoolbusfleet.com/article/713421/can-electric-school-buses-go-the-distance

8 https://motivps.com/americas-only-all-electric-school-bus-transports-students-saving-california-school-district-over-10000-a-year-in-fuel-and-maintenance-march-3-2014/

9 https://www.arb.ca.gov/msprog/bus/battery_cost.pdf

Sustainable Transportation Solutions for Maine

Maine’s climate and transportation policymaking is at a critical juncture. Last week, the Governor’s Energy Office convened an expert task force of private, public, and non-profit stakeholders to consider the challenges and opportunities ahead and to develop the Maine Energy Roadmap. The group faced complex and seemingly contradictory goals.

Through one lens, maturing transportation technologies are transforming the marketplace. Most major automakers already offer electric vehicles, dozens of additional long-range, reasonably-priced models are in development, and Volvo will sell only hybrid or electric vehicles starting in 2019. As options expand, battery ranges increase, and costs fall, Maine consumers will increasingly choose EVs for their lower driving and maintenance costs and lighter environmental impact. Fossil fuels burned for transportation are responsible for 40% of Maine’s greenhouse gas emissions—the largest share of any sector—and Acadia Center’s EnergyVision 2030 project shows that electric vehicle adoption is crucial to reducing climate pollution and meeting Maine’s climate targets. Clearly, we should do everything we can to support consumer access to electric vehicles.

Changes in vehicle technology are revealing that traditional transportation funding is out of step with an evolving marketplace and that new approaches are needed so Maine can enjoy a first class transportation system. Maine’s current funding for transportation infrastructure relies primarily on taxing gasoline. Without significant revision, this mechanism will not support a system in which drivers choose vehicles that do not depend on gasoline or diesel fuels. Proposals to impose fees on EVs and hybrids in an attempt to capture lost gas-tax revenue is not the answer—EVs and hybrids only make up about 1% of all the cars in Maine and have had little impact on overall transportation funding. Imposing fees and taxes that target a new, innovative, lower cost technology will not solve Maine’s transportation revenue needs and only act to burden consumers. Clearly, Maine policy should not stand in the way of consumer choice.

The Governor’s Energy Office doesn’t have to choose between accelerating EV adoption and strengthening infrastructure investments. If it’s willing to think differently, rely on accurate data, and distinguish between fair and equal contributions to transportation funding, the Maine Energy Roadmap could set a course to do both.

Recommendations for the Maine Energy Roadmap

Electric vehicles benefit all Mainers. Electric vehicles are a practical way for consumers to control their transportation expenses. Even with low gas prices, fuel efficiency is one of the top 9 reasons consumers choose a vehicle, and electric vehicles offer the additional benefit of lower maintence costs. Even drivers of convential vehicles benefit from expanded EV adoption, thanks to reduced greenhouse gas emissions, lower conventional pollution, and economic contributions to the state budget—from sales tax on electricity and electric systems benefits charges t0 elevated excise and sales taxes compared to conventional vehicles due to their higher value.

Maine should actively support EV adoption. Ramping up EV adoption will require clear goals and concrete policy actions. Maine should join the cooperative, Multi-State Zero Emissions Vehicle Memo of Understanding, which would commit Maine to putting close to 51,000 zero-emission vehicles on the road by 2025. Consumer incentives toward the purchase of new electric vehicles and EV charging equipment would support this ambitious goal.

Maine should explore consumer-friendly transportation funding mechanisms. Transportation funding mechanisms must evolve to keep pace with a changing marketplace and ensure that all drivers contribute fairly to infrastructure maintenance. The energy sector’s Regional Greenhouse Gas Inititative offers a successful mechanism to create revenue for reinvestment in Maine projects while capping climate pollution emissions. Acadia Center is working with regional partners to adapt this proven, market-based approach to transportation. Additional transportation funding solutions may be implemented as EV technology continues to mature and reaches market maturity.

Meeting Maine’s climate and emissions reduction goals should not undermine our ability to invest in our roads and highways. The Maine Energy Roadmap can facilitate these complex, crucial goals.

New Reports Show Electric Vehicle Market Is Taking Hold

Confidence in electric vehicles (EVs) is growing. Several recent announcements demonstrate that many industries are convinced EVs will play a major role in the future of personal vehicles. Bloomberg New Energy Finance (BNEF) recently forecasted that EVs will make up about 58% of vehicle sales in the U.S. by 2040. This month, Volvo committed to producing exclusively EVs and hybrids by 2019. And even OPEC, the representative body of oil producing nations, has begun to predict a significant impact from EVs—Bloomberg Technology just reported that the oil group quintupled its 2040 EV forecast from last year.

These updated EV predictions are largely driven by rapidly declining battery costs, which in turn drive down the cost of these clean vehicles. BNEF’s forecast shows that battery prices have dropped by 73% since 2010 to about $200/kWh, and they predict this trend will continue. These estimates may even be conservative for some manufacturers, as they are based on average battery prices. Tesla announced in 2016 that they were already below the $200/kWh threshold, and they expect further cost reductions from large-scale production at their Gigafactory. With these battery cost predictions, BNEF forecasted that the cost of manufacturing EVs would match conventional vehicle costs by 2025.

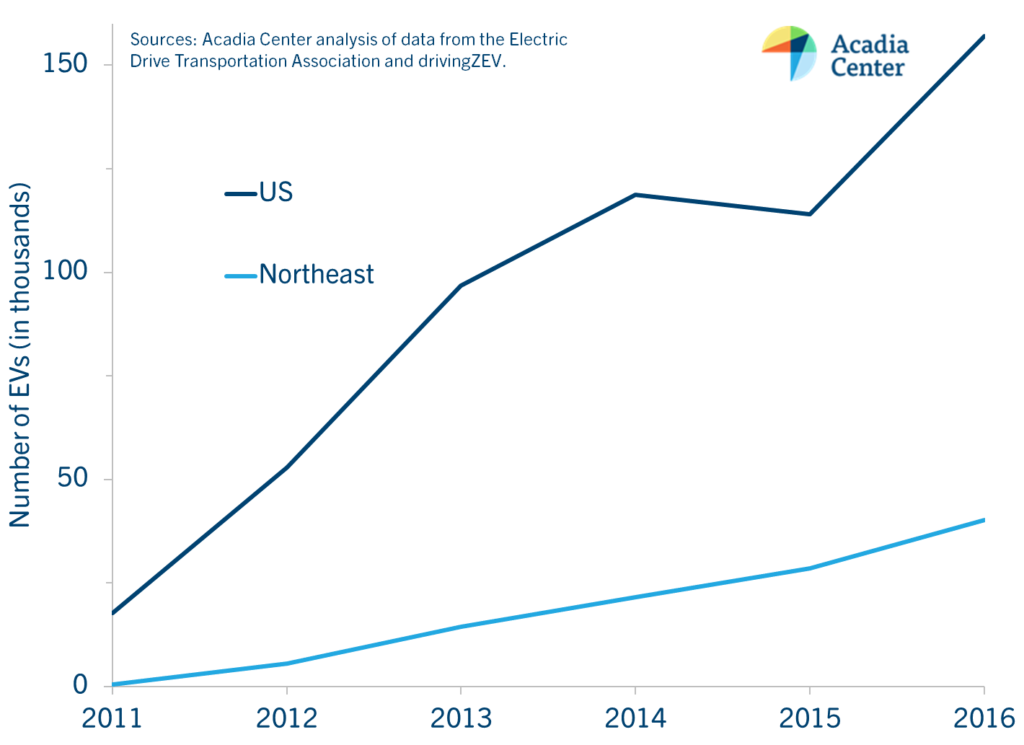

EVs already have lower lifetime costs than conventional vehicles, and consumers are catching on to these benefits. In the U.S., EVs sales in the first six months of 2017 have increased about 35% compared to the same period last year. In the Northeast, which comprises about 25% of the EV market, the annual growth rate of EV sales has been about 40% since 2013. Acadia Center’s EnergyVision 2030 highlights the current fuel cost savings and emissions benefits of EVs in the Northeast region. The lower EV purchase prices predicted from decreasing battery prices will further increase consumer savings.

New EV Sales in the U.S. and the Northeast, 2011-20161

But batteries are not the only driver of EV costs. BNEF also highlights the importance of supportive policies in the next six to eight years to maintain the momentum around EVs. Some existing policies are facing uncertainty because of actions by the Trump administration. Without them, market dynamics for EVs could change, resulting in slower cost reductions and delayed adoption. In the wake of Federal uncertainty, states should continue to act in strong support of EVs. Acadia Center’s Charging Up report—coauthored with Sierra Club and Conservation Law Foundation—outlines policies that states in the Northeast can adopt to show they are ready for and supportive of the growing EV market.

1 Data for the Northeast includes the New England states and New York. Data from the Electric Drive Transportation Association and drivingZEV.

EnergyVision 2030 for Massachusetts

Massachusetts has a strong record addressing climate-changing pollution. In the early 2000s, Massachusetts was a founding partner in the Regional Greenhouse Gas Initiative (RGGI), a multi-state, bipartisan cooperative that has contributed to a 50% drop in power plant emissions. Passage of the Green Communities Act in 2008 led to nation-leading energy efficiency policies that reduce energy waste and save consumers billions of dollars. Last year, the Baker Administration and Legislature collaborated on landmark legislation to launch the U.S. offshore wind industry, enable further growth of onshore wind and solar power, import Canadian hydroelectricity, and place the Commonwealth at the forefront of the booming energy storage industry. Most recently, Gov. Baker committed Massachusetts to the United States Climate Alliance, a partnership of 13 states honoring the tenets of the Paris Agreement.

The Commonwealth must follow through on policies and commitments to achieve a 25% reduction in carbon pollution by 2020, which is legally mandated under the Global Warming Solutions Act (GWSA). The GWSA additionally requires an 80% reduction by 2050, which will require the replacement of virtually all fossil fuels with clean, renewable electricity to power and heat buildings, and to ‘fuel’ electric vehicles.

Acadia Center’s recently-released EnergyVision 2030 describes the technology and policy benchmarks that Massachusetts and the broader region will need to achieve over the next 13 years to stay on track for deep emissions reductions. Massachusetts is already making progress toward most of these goals, aided by declining technology costs, changes in consumer preferences, and policy leadership.

Here’s what needs to happen next:

Set Ambitious Renewable Energy Targets

The Renewable Portfolio Standard (RPS) determines the share of renewables in Massachusetts’ (and the region’s) energy mix, and should be doubled from the current 25% requirement by 2030 to 50% or more. Renewables displace carbon pollution from fossil fuel power plants and stabilize costs, and cleaner electricity provides greater emissions savings from electric vehicles and heat pumps (more below).

Bulk Up on Clean Energy

Large-scale long-term contracts are needed to finance the up-front cost of developing clean energy projects and move energy to demand centers. Massachusetts is implementing separate procurements for 1) land-based renewables and hydroelectricity, and 2) offshore wind. Partnering with neighboring states to implement these procurements will achieve greater economies of scale, and encouragingly, Rhode Island and Connecticut have taken steps to join the solicitation issued by Massachusetts utilities to develop the region’s world-class offshore wind resource. Additionally, Massachusetts should jump-start efforts to build a renewable-ready bulk transmission grid to unlock potential for onshore wind in northern Maine and New York, and to facilitate continued development of offshore wind as more states commit to harvesting the abundant energy resource and capturing a share of the economic development that will follow.

Set Solar Free

Caps on solar net metering (the rate compensation mechanism for solar energy sent back to the grid) are stifling deployment and should be removed. 2016 legislation made changes including reducing solar incentive payments to account for lower technology costs and providing options for the Department of Public Utilities to establish payment mechanisms to support grid maintenance. Acadia Center takes issue with some of these changes, but regardless of policy details, lower incentives and assured payments for grid upkeep mean that net metering caps are no longer justified.

Put a Price on Pollution

Climate pollution imposes significant costs on society, and pricing pollution to reflect these costs will drive changes in market behavior while raising revenue to reinvest in complementary programs and/or rebate to consumers. By charging power plants for pollution permits, the successful RGGI program has helped clean up the air while raising billions of dollars for Massachusetts and other states to reinvest in energy efficiency programs. Building on this success, Massachusetts should continue leading regional partners to set ambitious targets for the program through 2030. Pollution pricing must also be expanded beyond the power sector. This can be achieved through innovative carbon pricing proposals that packed a Statehouse auditorium at a recent hearing. Regional progress on transportation emissions can simultaneously be achieved through the Transportation Climate Initiative, a multi-state collaborative to reduce transportation climate pollution through market-based policy and other means.

Get Off Gasoline

With current sources of electric generation, driving on electricity already reduces pollution, and as the share of renewable generation increases the climate benefits of electric vehicles increase in step. Massachusetts has committed to putting 300,000 EVs on the road by 2025. To achieve this target and accelerate uptake of EVs through 2030, the Commonwealth will need to ensure long term funding for consumer rebates, implement a robust public charging network, and enact discounted “off-peak” electricity rates, which will both reduce strain on the grid and lower fueling costs for EV drivers.

Electrify Heating

Modern, efficient heat pumps—a form of efficient electric heating for residential and commercial buildings—are now capable of heating buildings during the coldest New England winters, providing a substitute for natural gas and oil. Heat pumps are also more efficient than traditional air conditioners, providing year-round savings. Heat pumps are offered within MassSave energy efficiency programs and through state grants, and the benefits of this mature clean technology should be extended to more customers through targeted low-income programs, contractor education, and through inclusion in the Alternative Energy Portfolio Standard. Switching from oil to heat pumps does not require expensive and disruptive construction of natural gas mains, and by drawing ‘fuel’ from an increasingly clean grid, heat pumps produce significant GHG reductions.

Modernize the Grid

Massachusetts needs a modern, flexible grid that can accommodate new consumer-based resources and can rely on clean local technologies over centralized power stations and traditional utility infrastructure. Utility financial incentives set by regulators should be structured to promote innovation, consumer empowerment, and reduction in overall energy system costs. Forward-looking utility proposals for electric vehicle charging infrastructure and energy storage should be encouraged within the context of broader efforts to modernize the grid. Massachusetts’ existing Grid Modernization proceeding has produced inadequate and inconsistent utility proposals. Legislation to promote local energy investment and infrastructure modernization would ensure consistent state-wide planning for a modern grid and level the playing field for clean, local energy resources.

Avoid Unnecessary Pipelines

Putting Massachusetts and the region on the EnergyVision 2030 track would reduce demand for natural gas heating and demand for electricity from natural gas power plants such that no additional pipeline capacity would be needed. By lessening the region’s dangerous overreliance on natural gas, the Commonwealth would reduce pollution and protect consumers from risks of cost overruns, price volatility, and stranded expenditures associated with subsidized natural gas pipelines.

We have the technologies, and we know the policies needed to achieve a sustainable, low-pollution energy system. 2030 will be here before we know it, so let’s get to work.

This post was also published on CommonWealth magazine.

How Can We Replace Traditional Infrastructure with Clean Energy?

In March, Acadia Center released an analysis demonstrating that outdated financial incentives are driving expenditures on expensive and unnecessary utility infrastructure and inhibiting clean energy in the Northeast. The report, Incentives for Change: Why Utilities Continue to Build and How Regulators Can Motivate Them to Modernize, shows that under current rules, utilities can earn more money on infrastructure expenditures like natural gas pipelines and electric transmission lines than on cleaner, local energy resources like energy efficiency, rooftop solar, and highly efficient electric heat pumps. The key takeaway from the analysis is that without changes to the way they are regulated and rewarded, utilities will continue to advocate for infrastructure over local energy resources because their fiduciary duty to shareholders requires it.

Meanwhile, experience throughout the Northeast shows that clean, local energy resources can replace expensive grid infrastructure proposed by utlilities. These local alternatives include energy efficiency and demand response technologies that reduce demand for electricity at specific times, as well as roof-top solar, battery storage, and efficient combined heat and power.

Energy efficiency investments alone have avoided over $400 million in major transmission upgrades in Vermont and New Hampshire.1 Similarly, the Tiverton/Little Compton pilot project in Rhode Island,2 the Brooklyn/Queens Demand Management Project in New York,3 and the Boothbay Smart Grid Reliability Project in Maine4 are real world examples of local clean energy resources deferring or avoiding upgrades to the distribution grid. Earlier this year, expert witnesses for the New Jersey Division of Rate Counsel argued that a $75 million, 10-mile transmission line is no longer needed due to increasing adoption of distributed generation.5 There are additional examples from California also, where the state’s grid operator (California Independent System Operator, or CAISO) announced in December 2016 that it is putting the Gates-Gregg 230 kV transmission line project on hold, and may cancel the project entirely, due to forecasted increases in the development of solar energy.6

These clean energy projects are possible when consumers are given the ability to shape a cleaner, lower cost energy system through their investment decisions and behaviors. To motivate utilities to give consumers these options, utility regulators need to adopt alternative economic structures that balance the need to bring clean energy resources on-line with the need to keep utilities financially healthy.

Acadia Center’s UtilityVision outlines an alternative economic structure to resolve this conflict. UtilityVision recommends that states adopt performance incentives to motivate utilities to advance priorities such as system efficiency, grid enhancements, distributed generation, energy efficiency, and other energy system goals. Regulators can then increase the portion of revenue recovered through those performance incentives while reducing the portion of revenue that is linked to infrastructure projects, helping to shift utility priorities further towards achieving the performance outcomes.

A handful of states are beginning to adopt reforms to focus the utility’s financial incentives on advancing public policy goals for clean energy development. On January 25, 2017, the New York Public Service Commission issued an Order approving a shareholder incentive to reward Con Edison for deploying distributed energy resources (DER) to defer or avoid traditional transmission and distribution projects and deliver net benefits to ratepayers. The PSC approved a shared-savings model that uses a benefit-cost framework to determine the difference between the net present value of DER and the traditional infrastructure solution. The PSC found that this reward structure effectively signals the utility to find the most cost-effective grid solutions for ratepayers and advances additional energy and environmental goals.7

The California Public Utilities Commission is taking similar steps to resolve the conflict between bringing more DER online and ensuring they do not harm utilities’ profits. In December 2016, Commissioner Florio issued an Order creating a model to financially incentivize utilities to adopt DER. The Order will incentivize the deployment of cost-effective DER that displaces or defers utility spending on infrastructure by offering the utility a reward equal to 4% of the payment made to the DER customer or vendor.8

Whether the New York and California model is the best of many ways to revamp the utility business model to incorporate DER is an open question. One limitation of this model is that it is based on a comparison between DER and the traditional infrastructure projects that would otherwise be built in their place. This model makes it relatively straightforward to compensate the utility based on the cost savings and greater net benefits from the DER solution, but it is not easy to apply to more general deployment of DER. For instance, in Rhode Island,9 stakeholders led by the Office of Energy Resources are considering how to reward the utility for proactively and strategically using DER to improve grid conditions and prevent problems before the grid gets to the point of needing infrastructure upgrades. In this case, the NY/CA model can’t be used because there isn’t a traditional infrastructure project to compare to the proposed DER.

States must continue to seek reforms to utility regulations so that clean energy can flourish and both consumers and utilities are treated fairly. Replacing poles, wires, transformers, and substation upgrades with rooftop solar, battery storage, demand response, and energy efficiency can reduce costs and make the grid cleaner—but utilities make a guaranteed rate of return on their million (and billion) dollar grid investments, and any lower cost DER alternatives threaten to undercut those revenues. Until a new system of incentives is created, it will be an uphill battle to achieve states’ goals for a lower cost, cleaner energy grid.

1Schelgel, Hurley, and Zuckerman, 2014, “Accounting for Big Energy Efficiency in RTO Plans and Forecasts: Keeping the Lights on While Avoiding Major Supply Investment.” http://aceee.org/files/proceedings/2014/data/papers/8-1215.pdf

2 Rhode Island Public Utilities Commission Docket No. 4581, “2016 System Reliability Procurement Report”. October 2015. http://www.ripuc.org/eventsactions/docket/4581-NGrid-2016-SRP(10-14-15).pdf

3 New York Public Service Commission Case 14-E-0302, “Petition of Consolidated Edison Company of New York, Inc. for Approval of Brooklyn Queens Demand Management Program.” June 15, 2014.

4 Maine Public Utilities Commission Docket No. 2011-238, “Final Report for the Boothbay Sub-Region Smart Grid Reliability Project.” January 19, 2016.

5 “Rate Counsel Sees No Need For High Voltage Transmission Line,” NJ Spotlight (Jan 19, 2017) available at: http://www.njspotlight.com/stories/17/01/08/rate-counsel-sees-no-need-for-high-voltage-transmission-line/

6 ”Solar Growth Puts Fresno High-Voltage Line on Hold,” Fresno Bee (Dec 20, 2016). Available at: http://www.fresnobee.com/news/local/article122063189.html

7 New York Public Service Commission, Case 15-E-0229, Petition of Consolidated Edison Company of New York, Inc. for Implementation of Projects and Programs that Support Reforming the Energy Vision, Order Approving Shareholder Incentives. January 25, 2017. http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterSeq=47911

8 California Public Utilities Commission, Decision 16-12-036, Rulemaking 14-10-003, Order Instituting Rulemaking to Create a Consistent Regulatory Framework for the Guidance, Planning, and Evaluation of Integrated Distributed Energy Resources. December 22, 2016. http://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M171/K555/171555623.PDF

9 More about Rhode Island’s Power Sector Transformation initiative can be found at: http://www.ripuc.org/utilityinfo/electric/PST_home.html

New Era of Natural Gas Exports Raises Concerns for Northeast

President Trump’s “Energy Week” address today is expected to express strong support for U.S. exports of natural gas, currently on the rise. For the Northeast, these exports exacerbate the risks of the region’s already-dangerous overreliance on a fossil fuel that has a history of volatile prices and will not allow the region to reach its commitments to reduce greenhouse gases.

With the arrival two weeks ago in Taiwan of a liquified natural gas (LNG) tanker ship loaded with American natural gas, June has been a month marked with milestones for the nascent export industry in the United States. Preceding this delivery by a few days were the first ever U.S. LNG shipments to Poland and the Netherlands. U.S. Energy Secretary Rick Perry deemed those events significant enough to warrant a statement from his office. These deliveries from a new LNG export facility in Louisiana signify a new era for the natural gas industry in this country, and residents of Northeastern states should be paying attention to these events.

This export plant, the Sabine Pass LNG Terminal, is the first of several such facilities planned to be constructed or converted from import use. When it is fully online, it will be able to liquify nearly 1,300 billion cubic feet (bcf) per year of natural gas. Five other facilities under construction in Hackberry, Louisiana, Freeport, Texas, Corpus Christie, Texas, Elba Island, Georgia, and Lusby, Maryland, will be able to liquify twice that volume. In total, these facilities will be able to liquify and export the equivalent of 15% of current U.S. natural gas consumption. Several additional projects have been approved but are not yet under construction.

Having this large a portion of U.S. natural gas consumption subject to world market prices will likely have an impact on markets at home. Such a rapid surge in demand will likely increase domestic natural gas prices. What does this mean for Northeastern states? They need to carefully scrutinize analyses of any projected benefits from natural gas conversions or new natural gas infrastructure projects in the region. The levels of promised savings may never materialize if rapidly increasing LNG exports drive up natural gas prices. The risk of these projects as proposed is almost always borne by ratepayers—the utilities or other project developers will earn their guaranteed return on investment, paid for eventually by electric or gas ratepayers, but the savings are not guaranteed.

Natural gas already stands as one of the main obstacles to reducing greenhouse gas emissions in the region, and concerns have been raised that subsidized pipelines could facilitate exports from facilities in Eastern Canada that—like Sabine Pass—were first built for imports. Tying domestic prices to volatile international markets layers on more risk.

The region’s policymakers should continue to proceed cautiously before committing their ratepayers to years of payments for large fossil fuel infrastructure projects whose tenuous savings can easily be wiped out by changing market conditions. All proposed projects should be evaluated against the possibility that other available resources can meet the Northeast’s energy needs without growing the region’s overreliance on natural gas. Northeast states need to consider energy efficiency, solar and wind generation, and conversion of fossil fuel heating and transportation systems to electric-powered alternatives. Acadia Center’s EnergyVision 2030 project shows the benefits of embracing energy sources that are indigenous to the Northeast region. With the expansion of U.S. natural gas in world markets, the economic benefits of local clean energy will likely only grow.

One Month In – Advocating for Clean Energy Policies in Connecticut

In this blog post, Acadia Center’s new Policy Advocate in Connecticut, Kerry Schlichting, shares her experience one month into her tenure at the organization.

I recently joined the Hartford team in late May, after eight years in Washington, D.C., working on energy policy issues with a national perspective, and was eager to apply my experience to challenges at both the federal and state level. As a new staff member, my experience over the past month in Connecticut’s exciting and fast-paced environment has shown me the depth and breadth of Acadia Center’s work and how much is possible in the state and regionally. With just over two weeks left in Connecticut’s legislative session, Acadia Center’s Hartford-based team made a final push for policies protecting and promoting the state’s clean energy goals while also fighting a proposal to divert funds from the state’s crucial energy efficiency programs. Meanwhile on the national stage, the decision to leave the Paris Climate Accord was announced, with lasting implications for climate and economy locally, regionally, and globally.

On just my second day, we organized a sign-on letter opposing proposed budget raids of ratepayer funds for energy efficiency and clean energy programs to send to CT officials. Over 70 signees—representing business, community, consumer, low-income, public health, environmental, and clean energy interests—came together against the harmful impacts that would flow from proposed raids on ratepayer-funded energy efficiency programs. The letter opposes two budget proposals, one made by Senate Republicans that would raid ratepayer-funded energy efficiency programs and another made by the Senate and House Democrats that would sweep ratepayer-derived revenues from the Regional Greenhouse Gas Initiative. These programs generate immense economic value for the state, from billions of dollars in electricity and natural gas bill savings to helping low-income families reduce the difficult burden of high energy costs, while also protecting the health and prosperity of our local communities. Budget negotiations are ongoing through the end of this month, and we continue to respond to changing proposals that threaten these important programs.

My second week saw the next major challenge as we learned of the threatened withdrawal of the Trump Administration from the Paris Climate Agreement. By pulling out of the Paris Agreement, the Trump Administration weakens our country’s position as an energy leader. This action also undermines progress being made globally, as well as at the national and state level, to address the growing harms of carbon pollution. The announcement by the White House underscores how much more important state leadership will be in advancing a clean energy future. The day of the White House’s announcement, representing Acadia Center, I spoke at U.S. Senator Richard Blumenthal’s press conference to decry this shortsighted decision that risks our country’s global climate leadership and hurts our economic interests around clean energy.

Yet, this moment also offers states and regions an opportunity to aim high and lead the transition to a clean energy future. During my third week, Acadia Center joined other advocates to thank Governor Malloy for committing Connecticut to the Paris Agreement’s climate pollution goals and to pursue policies that will help achieve those goals, as well as for being a leader in the new U.S Climate Alliance, a bipartisan commitment by governors throughout the country to commit to reducing climate pollution. A recent analysis by Acadia Center, EnergyVision 2030, shows that Northeast states can be on the path to a low-carbon future by the year 2030 if they commit to and embrace clean energy technologies. With further strategic action and expanding adoption of modern, market-ready technologies, Northeast states can reduce climate pollution emissions 45% by 2030: a target needed to put the region on the path to meet scientifically directed emission reductions of 80% by 2050.

With a special legislative session called to address the state budget, Acadia Center’s Connecticut team continues to advance policies that benefit consumers and the environment. To reduce the state’s greenhouse gas emissions as well as to accelerate the growth of our clean energy economy, creating new jobs and state revenue, the state needs policies that support our award-winning energy efficiency programs. Additionally, we need policies that make us competitive with our neighboring states in pursing clean energy resources. This includes strengthening the state’s commitment to renewable energy procurement and encouraging electrification of the transportation sector and increased deployment of electric vehicles.

Both federal and state policies can affect the state’s clean energy economy, and it is from that perspective that I look forward to the many opportunities and challenges that lie ahead. My experiences this past month have made me look forward even more to being part of a team advancing the clean energy future through fact-based, solutions-oriented advocacy and collaboration.