Restructuring for Net Zero – A More Unified Future Vision Emerges

Acadia Center’s President, Dan Sosland, was pleased to participate in the March 2024 Restructuring Roundtable event in Boston. The now decades-old convening that brings together key energy thought-leaders and stakeholders for timely discussions on the evolving market, technology, and policy landscape in New England. Borne out of the electricity industry restructuring of the late 1990s, it is fitting that the ‘restructuring’ title is still being used for these gatherings, as the ‘i-n-g’ ending connotes a process that is still actively unfolding today – nearly 30 years later. This convening focused specifically on wholesale electricity markets and the bulk power system in the region.

From all the presentations that were featured at the event, it is clear that the region is entering a new chapter in that restructuring journey – a future 2050 state coming into greater clarity, significant market changes currently in the works, and new challenges emerging that must be overcome together. Refreshingly, the conversation reflected a growing consensus about the future 2050 grid that the region must plan for and seek to achieve:

- Abundant clean energy resources like solar and wind delivering the majority of energy on an annual basis and dominating annual capacity additions onto the grid;

- Increased transmission to deliver new resources, such as offshore wind, better interconnect neighboring regions, and further unbottle/optimize contributions from resources already shaping daily and seasonal load profiles, such as distributed solar;

- Greater utilization of new solutions such as grid enhancing technologies (GETs) to help meet the imperative of consumer affordability and squeeze as much out of our existing grid as possible

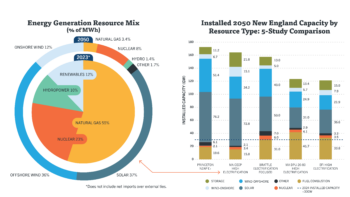

Acadia Center has been examining leading economy-wide analyses for decarbonization in New England, and it has assembled the following comparison to demonstrate just how significant these changes will be to the mix of generation resources serving the New England grid – and how glaring the gap is between where the region is today and where it needs to be in less than three short decades.

On the left above, you see the 2023 generation mix for ISO-NE in the inner circle, compared to how this generation mix must evolve by 2050, according to the MA CECP. (Neither of these includes imports). The takeaway? The region must move from 55% natural gas today to 85% solar and wind by 2050, in terms of annual MWh. On the right, Acadia Center compared findings on 2050 installed capacity (MW) from five prominent studies of deep decarbonization in the New England region, from Princeton, Brattle, and Energy Futures Initiative (EFI) to two studies from state processes – the MA Clean Energy and Climate Plan, and the DPU 20-80 modeling. Across these, Acadia Center has taken a look at their high electrification scenarios for an apples-to-apples comparison, although you see nonetheless some notable differences in projections for in-region build-out. Regardless of these differences, all these studies find a need for a substantial growth in installed capacity, growing from roughly 30 GW today to at least 120 GW by 2050, possibly up to 160 GW or higher. This is the glaring gap the region faces. As a region, we must build more than 30 GW of solar and more than 20 GW of offshore wind across all studies, likely more. The studies do foresee notable amounts of fuel combustion capacity remaining online, despite very low production from those resources.

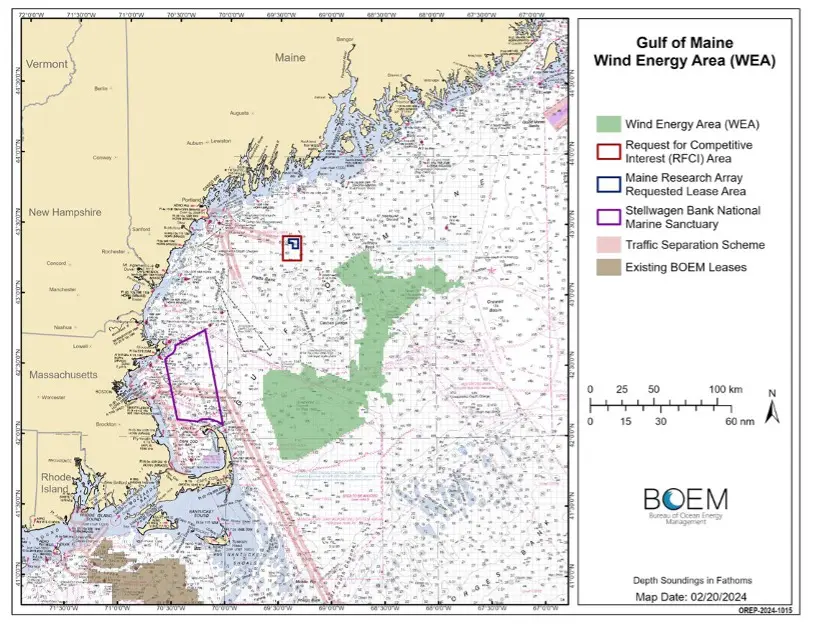

To realize this future state, the region’s wholesale electricity markets must be reformed to accommodate such major influxes of new clean resources at the scale and timeframe needed. ISO-NE presented on the proposed shifts to a prompt and seasonal capacity market from the current Forward Capacity Market construct, and other presenters focused on the parallel resource capacity accreditation (RCA) process underway. Both are major capacity market design reforms, and we argued that these processes must fully value clean energy resources for the benefits they provide (including, e.g., fuel saving during peak periods) and allow for swift and reliable market entry – which also ties into interconnection reform. We highlighted the recently finalized Gulf of Maine wind energy area (WEA) from the Bureau of Ocean Energy Management (BOEM) to underscore that these volumes of new clean resources – 30 GW in this case – are eminently feasible from a technical potential standpoint, so the region’s markets must adapt and evolve as a result.

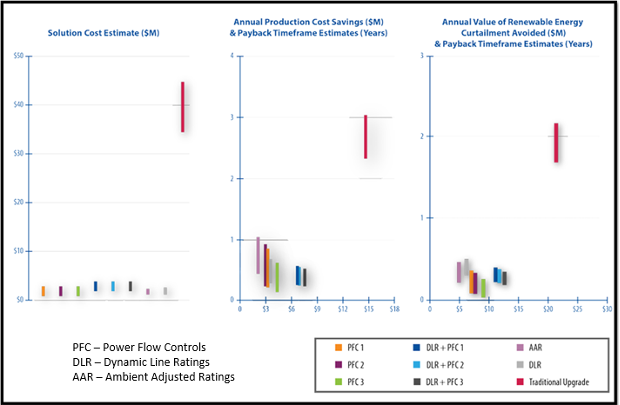

The discussion turned next from the electrons to the poles and wires – the state of the future grid the region will need to match growing influxes of clean supply with growing electric demand from buildings and transportation. Dan went on to emphasize the importance of GETs, underscoring that consumers are currently missing out on big benefits and cost saving opportunities by failing to adopt GETs at scale. The figure below from an Idaho National Lab study on GETs in ISO-NE shows the costs and benefits associated with each of the technology strategies, with the GETs toward the bottom and the traditional upgrades in the longer red bars. Each of the GETs options has a payback period in months (not years) regardless of the metric used to assess. The study found that Power Flow Controls (PFC) and Dynamic Line Ratings (DLR) together can be better than each individually. The bottom line: GETs are a cheaper, quicker, and higher value option to traditional upgrades.

Dan also highlighted transmission asset condition projects (ACPs) as another major low-hanging fruit, with a need for tariff reform. Acadia Center strongly agrees with the spirit of the NESCOE letter to transmission owners on these ill-governed projects:

“…the process by which Asset Condition Projects are developed by NETOs, reviewed by ISO-NE, states and the public, approved for rate recovery, and considered in overall transmission system needs and planning is antiquated and ultimately, inadequate. It is the right time to implement planning process improvements to protect consumers from excessive costs and to maximize the use of all transmission assets by moving Asset Condition Projects from the current siloed, notice-based method into meaningful and holistic transmission system planning.”

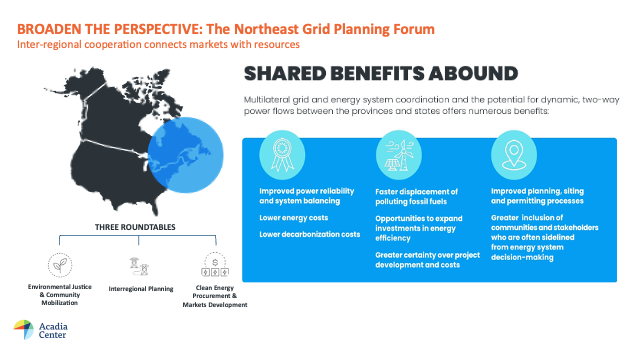

Finally, Dan touched on a big missing piece of the puzzle, long overdue for incorporation: improved interregional grid planning and coordination. This requires broadening the discussion beyond the six New England states to reach into New York and into Eastern Canada, the other jurisdictions that compose the Northeast Power Coordinating Council (NPCC) region. Specifically, we took the opportunity to highlight our Northeast Grid Planning Forum (NGPF) project, which is seeking to bring not only these states and provinces together but also the community stakeholders and clean energy market participants who must necessarily have prominent voices in this collaboration. To us, the benefits of this interregional opportunity make it a highly logical priority:

If you missed the Roundtable discussion, slides and recordings from the presentations are available online here. Acadia Center thanks both Raab Associates and our fellow presenters at NPCC, ISO-NE, Connecticut DEEP, the Massachusetts AGO, LS Power, and Vineyard Offshore for an engaging and lively discussion. It’s time to get to work to make this future vision a reality for New England the northeast.

Follow us