RGGI 63rd Auction: An Additional $388 Million Raised for Clean Energy

FOR IMMEDIATE RELEASE

RGGI 63rd Auction: An Additional $388 Million Raised for Clean Energy

For Release: March 20, 2024

BOSTON, MA – On Wednesday, March 6, 2023, the ten states participating in the Regional Greenhouse Gas Initiative (RGGI) released the results of the 63nd auction for 2024. Emissions allowances were sold for $16.00 each, generating $388 million for clean energy investments in participating states.

“The strong success of this auction speaks volumes—$388 million raised brings RGGI’s cumulative total to a staggering $7.5 billion,” stated Paola Tamayo, Policy Analyst at Acadia Center and co-author of the organization’s RGGI Third Program Review Report.

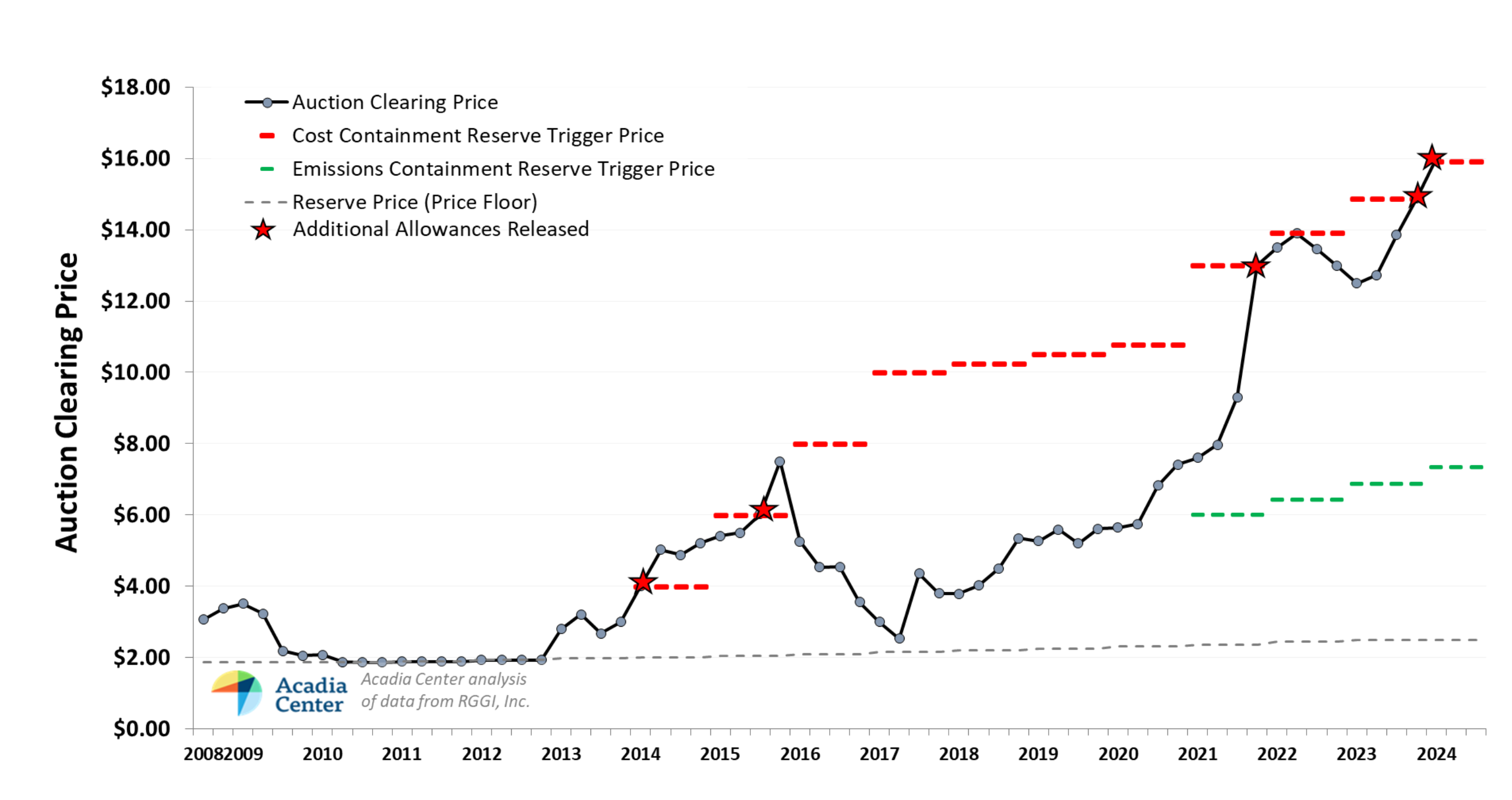

The allowance price of $16.00 is the highest level observed historically since the RGGI program’s inception. RGGI auctions stand as a crucial mechanism for curbing carbon emissions and charging power plants for their climate pollution. Among the various instruments within RGGI auctions, the Cost Containment Reserve (“CCR”) – a market mechanism that releases extra allowances beyond the cap which are sold if prices exceed predetermined levels – was triggered again in this auction. The Trigger Price of $15.92 per ton of CO2 was met, and 8,416,278 CCR allowances were sold in the auction. The CCR was initially conceived to be a safeguard, only to be triggered in times of extraordinary circumstances. However, recent trends have shown a worrisome pattern: in the latest auction, the CCR was triggered for the second consecutive time. This auction highlights the importance of reassessing the CRR trigger price in this Program Review. By raising the CCR cost, more breathing room is created for auction prices to rise, ensuring the effectiveness of the RGGI cap in reducing emissions.

Furthermore, the Emissions Containment Reserve (ECR) retains allowances for additional emissions reductions if prices fall below the trigger price of $7.35 in 2024. Notably, the ECR remains well below the auction price and has historically not been triggered. That means that the auction price was over two times higher than the trigger price, signaling a significant deviation from the original intent of this program mechanism. For the ECR to maintain its effectiveness as a market stabilizer, it should show a more dynamic response to fluctuations in auction prices. While the ECR serves as a vital safety net, its rigid structure makes the effect of this mechanism negligible in the face of rising auction prices. As stakeholders engage in discussions surrounding the third program review, there’s a pressing need to reevaluate the mechanisms governing the ECR. By introducing greater flexibility and adaptability into its design, the ECR can better fulfill its role in ensuring the stability and integrity of the RGGI market, ultimately driving progress towards a more sustainable future.

Higher RGGI allowance price is good for climate, clean energy investment

The clearing price of $16 for the first auction of 2024 marks a continuation of the upward trend observed in recent years. This clearing price represents a 28% increase from the clearing price in March 2022 and an 8% increase from the last auction. The positive trajectory witnessed in the 2023 auctions and this first auction of 2024 holds promising implications for the RGGI program. Higher observed allowance prices in 2022, 2023 and now 2024 means that the RGGI program is sending a stronger incentive to reduce fossil fuel emissions and produce electricity from carbon-free sources, like wind and solar.

Since the program launched, the vast majority of RGGI proceeds have been invested in energy efficiency and clean energy projects, as detailed in the most recent report on RGGI investments in 2021, released in June of last year. We are also hoping for a more timely and transparent reporting system on proceeds investments. As the auctions generate significant revenue, it’s crucial to ensure that these funds are allocated efficiently and effectively towards clean energy and energy efficiency initiatives.

The $388 million in proceeds generated in this auction brings the cumulative to-date total to $7.5 billion. The 2023 and 2024 auction results underscore RGGI’s significance as more than a regulatory framework, emphasizing its influence on the shift towards sustainable energy. RGGI states show the practicality of a collaborative, market-driven strategy for reducing greenhouse gas emissions.

RGGI Third Program Review Offers an Opportunity to Direct Proceeds Towards Clean Energy Investments that Directly Benefit Environmental Justice Communities

Since its establishment, RGGI’s priorities have centered around reducing pollution from fossil fuel power plants and achieving climate solutions for RGGI states. Every five years or so, RGGI undergoes a program review, giving the participating states the opportunity to consider the program’s performance and make various changes, including the equitable disbursement of the program’s proceeds. RGGI’s Third Program Review is happening now and is expected to conclude relatively soon this year. In 2023, RGGI held two public meetings and two public comment periods to discuss and seek feedback on various aspects of the program. Acadia Center, other stakeholders, and the public at large await any responses from the states to public input on setting the cap and improving overall program design and operation.

As discussed in more detail in Acadia Center’s most recent RGGI Report, there are many different ways in which RGGI can ensure that environmental justice communities are heard and are actively involved in the development of strategies for an equitable transition to a carbon-free economy. Regardless of how strongly the Third Program Review does or does not prioritize environmental justice, it should remain a priority for individual states to consider the recent auctions, the history of investments across the states, the need to benefit environmental justice communities directly, and other mechanisms associated with the cap-and-invest program.

Acadia Center remains closely involved in RGGI policy conversations across the RGGI states and will continue to advocate for program reforms that drive equitable investment and climate action.

Media Contacts:

Ben Butterworth, Director: Climate, Energy, and Equity Analysis

bbutterworth@acadiacenter.org, 617-742-0054 x111

Paola Moncada Tamayo, Policy Analyst

ptamayo@acadiacenter.org, 860-246-7121 x204

Follow us