The Inflation Reduction Act Makes Climate Change History

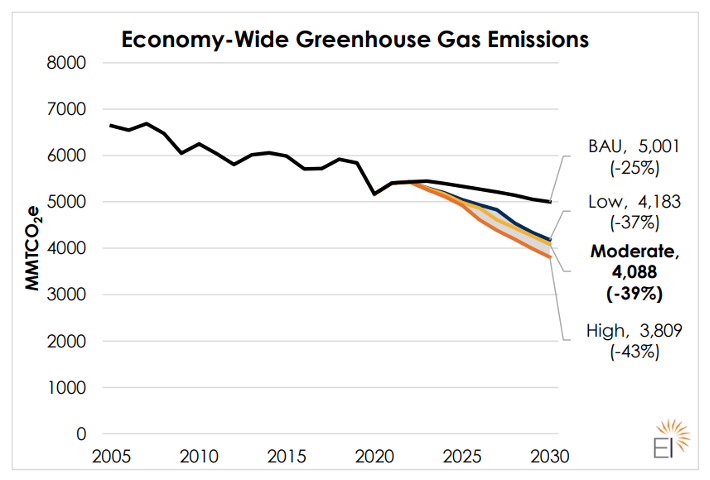

The Inflation Reduction Act has passed in the Senate, the House of Representatives, and has been signed into law by President Joe Biden. Alongside desperately needed funding for healthcare, this bill is the first major clean energy investment ever passed in the U.S. The IRA will invest $386 billion dollars into climate related initiatives. Prior to the adoption of the IRA, the U.S. was estimated to be on track to reducing greenhouse gas (GHG) emissions 25% below 2005 levels by 2030. With the IRA, 2030 emissions are estimated to be about 40% below 2005 levels – demonstrating the magnitude of the bill in reducing emissions. The figure below demonstrates how U.S. “business as usual” (BAU) GHG emissions without the IRA compared to the “low,” “moderate,” and “high” emissions scenario trajectories associated with the IRA.

According to analysis conducted by Energy Innovation, the IRA also has the potential to deliver significant public health and economic benefits, preventing up to 4,500 premature deaths in 2030 and creating up to 1.3 million jobs in 2030. Let us break down where the $386 billion in the bill is going:

- $161 billion for clean electricity tax credits

- $40 billion for air pollution, hazardous materials, transportation, and infrastructure

- $37 billion for individual clean energy incentives

- $37 billion for clean manufacturing tax credits

- $36 billion for clean fuel and vehicle tax credits

- $35 billion for conservation, rural development, and forestry

- $27 billion in building efficiency, electrification, transmission, industrial, DOE, grants, and loans

- $14 billion in other energy and climate spending

The total cost of the bill, including the healthcare components, comes out to $485 billion spent over the next ten years. However, the investment is predicted to bring in roughly $790 billion in that same period, meaning this bill is projected to have a net profit of $305 billion over the next decade. That profit will go towards reducing the deficit and controlling inflation.

The IRA represents the most significant federal action to fight climate change in our nation’s history, taking specific steps to address greenhouse gas emissions from buildings, transportation, and power generation. Here are how the investments align with Acadia Center’s longstanding mission to “Advance the Clean Energy Future” throughout the Northeast.

Buildings

First and foremost, the IRA offers significant federal resources to advance a package of actions Acadia Center calls “Next Generation Energy Efficiency.” Acadia Center has been working throughout the northeast to urge utility companies and regulators to prioritize making our region’s homes and businesses more thermally comfortable and energy efficient through simple actions like better insulation and air sealing of building envelopes as well as replacing inefficient fossil fuel appliances like furnaces, boilers, water heaters, and cooktops with superior all-electric appliances. The combination of these steps significantly reduces the overall amount of fossil fuels used in these buildings, reduces energy bills, and improves overall quality of life by making our living and working spaces healthier, safer, and more versatile.

By focusing these coordinated activities on especially high emitting buildings in our region, we can amplify these multi-faceted benefits even further. For instance, in the residential sector, the leakiest 25% of housing units in New England produce more than half of greenhouse gas emissions attributable to housing. Statistically, these households are far more likely to be low-income and occupied by renters. Nearly all (96%) of high emitting housing units are heated by fossil fuels, which are several times less energy efficient than all-electric heat pumps. Tens of billions for investments in building retrofits and energy efficiency will yield a significant reduction in local air pollution and global greenhouse gas emissions.

What it means for you:

The IRA introduces a slew of new tax credits and upfront discounts for clean building technologies for both homeowners and renters alike. All homeowners, regardless of income, will have access to tax credits to support the purchase and installation technologies including geothermal heat pumps, air source heat pumps, heat pump water heaters, and electrical panel upgrades that are sometimes necessary to support the installation of these technologies. As an example, tax credits for heat pumps will be as high as $2,000.

Low-income (defined as less than 80% of median area income) and moderate-income (80%-150% of median area income) homeowners will have access to several upfront discounts for technologies including heat pumps, heat pump water heaters, electric induction stoves, heat pump clothes dryers, electric panel upgrades, and electric wiring upgrades. As an example, upfront discounts for heat pumps will be as high as $8,000. Upfront discounts for moderate-income households will cover up to 50% of the project cost, while discounts for low-income households will cover up to 100% of the project cost. Low-income and moderate-income renters have access to upfront discounts for clean building technologies that could be relocated in the event of a move, including heat pump window units, electric stoves, and heat pump clothes dryers. A combination of tax credits, upfront discounts and performance rebates will also be available to improve the efficiency of homes – ranging from basic weatherization to more comprehensive retrofits.

Additional measures in the IRA will work to address rampant levels of methane leakage occurring throughout the country related to the production of “fossil gas” also known as “natural gas.” This gas is primarily methane, which has a global warming potential of over 80 times that of carbon dioxide in its first 20 years in the atmosphere. Leaking methane is also a significant safety hazard as leaks in the distribution pipes and inside of households are responsible for fires and sudden catastrophic explosions. Specifically, the IRA calls for the implementation of a “methane emissions charge” for oil and natural gas production facilities that are not in compliance with EPA methane emissions regulations.

Acadia Center’s Beyond Gas initiative works to reduce the combustion and leaking of methane by transitioning both power generation and buildings away from today’s overreliance on fossil gas and by prioritizing the strategic repair of leaking pipe sections that are not immediately ready for decommissioning.

Transportation

Acadia Center has long worked on a multi-pronged Clean Transportation strategy to reduce tailpipe emissions through electrification of vehicles, expanding transit access and improving networks, and connecting communities through investments in safe, dedicated pedestrian and bicycle infrastructure. The IRA falls short of taking significant actions to modernize transit and personal mobility infrastructure networks[1], but does prioritize historic measures to accelerate vehicle electrification, ranging from personal vehicles to heavy-duty vehicles like buses and garbage trucks.

What it means for you:

The IRA includes a first-ever $4,000 consumer tax credit for lower/middle income individuals to buy used electric vehicles and up to $7,500 in tax credits to buy new electric vehicles—these programs will effectively extend and expand the current federal electric vehicle incentives that have started to expire under existing law. The tax credits for new vehicles are available to those with an adjusted gross income (AGI) below $150,000 (filing taxes as single) or $300,000 (filing taxes jointly), while the tax credits for used vehicles are available to those with an AGI below $75,000 (filing taxes as single) or $150,000 (filing taxes jointly). Plug-in hybrid electric vehicles (PHEVs), which use both electricity and gas, will still qualify for the tax credit if they have a battery of at least 7 kWh in size, a threshold that nearly all models meet.

However, the EV tax credits will not necessarily be easy to navigate for consumers in the short term. To be eligible for the full tax credit, vehicles must both be 1) Assembled in North America and 2) Source the critical minerals need to make the batteries from a U.S. free trade partner. This policy has created some near-term uncertainty for which specific makes and models will qualify. For example, Hyundai and Kia do not currently produce any EVs in North America despite having several EVs available to U.S. consumers. For those seeking more information, electrek is maintaining a detailed list of which vehicles do and do not qualify for the tax incentive under these new requirements.

The law also includes tax credits and grants for clean fuels and clean commercial vehicles to reduce emissions and $3 billion for the U.S. Postal Service to purchase zero-emission vehicles to replace its aging fleet of vehicles that travel throughout our communities every day.

Additionally, the IRA provides $3 billion in Neighborhood Access and Equity Grants that can support neighborhood equity, safety, and affordable transportation access via competitive grants to reconnect communities long divided by redlining practices that developed transportation infrastructure in a manner that intentionally split apart neighborhoods, many of which were primarily inhabited by people of color. These grants can also be used to mitigate the negative impacts of transportation facilities on disadvantaged or underserved communities, as well as to support equitable transportation planning and community engagement activities that should be at the heart of all community-led decision-making processes.

The IRA also provides $3 billion in grants to reduce air pollution at ports, including for the purchase and installation of zero-emission equipment and technology. This will reduce the amount of fossil fuels burned by idling ships and local port machinery and trucking operations. These strategic investments to reduce the amount of heavy-duty vehicle and machinery emissions directly aligns with work Acadia Center has led in the past to address particulate matter emissions generated by diesel engines in overburdened and underserved communities, particularly school buses which expose communities and school children directly to health impacts from poor air quality.

Power Generation

To sustainably power today’s economy and support the transition from fossil fuel burning appliances and vehicles, the IRA makes critical investments to accelerate the expansion of responsibly sited renewable energy resources, including in rural communities. About two thirds of the estimated greenhouse gas emission reductions resulting from the IRA in 2030 are expected to come from the electricity sector. Two of the key provisions driving this reduction are the 10-year extension of the Production Tax Credit (PTC) and Investment Tax Credit (ITC) which have been critical financial carrots driving the rapid deployment of wind and solar. Solar projects will be able to access the PTC for the first time and battery storage, which is critical for accessing the full benefits of renewable electricity, will have access to the ITC for the first time. Combined, the extension and expansion of these tax credits, along with other clean energy provisions in the IRA, will be critical in continuing to drive down the costs of renewable electricity and accelerating the shift away from fossil fuel electricity generation in favor of renewable electricity generation in the northeast.

What it means for you:

The IRA provides a 30% tax credit to all homeowners, regardless of income, to support the purchase and installation of residential rooftop solar and/or battery storage. Both tax credits are in effect for the next 10 years. The battery storage tax credit is brand new, and the solar tax credit represents a long-term extension of the existing solar tax credit that was previously set to decrease and fade away over the next couple of years.

However, these projected declines in electricity sector emissions will not be realized without addressing existing policy barriers hampering the deployment of cheap renewable energy. The challenges currently facing the construction of transmission lines and the interconnection of renewable electricity to the grid continue to persist. That is why Acadia Center remains focused on tackling these complex and technical issues that arise in the transition to a clean energy future.

Acadia Center’s Clean Power and Utility Innovation programs have tirelessly worked to push regulators and the incumbent fossil fuel-utility industrial complex to update business models to prioritize investments in clean energy and dynamic energy systems that provide greater economic and societal benefits to end users. The IRA buttresses that work by incentivizing investments to develop and deploy historic levels of clean energy and to provide support for more robust local participation in permitting and regulatory processes that are key to developing those resources responsibly and with community input.

The IRA also includes more than $20 billion to support climate-smart agriculture practices. Acadia Center partnered with the American Farmland Trust and other organizations to develop the Smart Solar Siting Project for New England that seeks to co-locate renewable energy resources on parcels that also host agricultural activities—a winning strategy that keeps the Northeast’s precious farmland in agricultural use and provides farmers a source of clean, renewable energy and diversified revenue stream to maintain their farm operations for generations to come.

Overall, the IRA represents a great step forward in U.S. climate policy but there is still much work to be done – much of which will need to occur at the state and local levels – to actualize the full potential of the IRA. Acadia Center’s work across its core initiatives will be crucial in ensuring that the IRA delivers the maximum amount of emissions, economic, health and equity benefits to northeastern states.

[1] While the IRA itself may fall short on transit and personal mobility network investments, other large federal legislation of the past few years, such as the American Rescue Plan Act and Infrastructure Investment and Jobs Act, have provided some direction to those priorities.

Follow us